Amazon has become the default shopping destination for pet owners, with over 70% of U.S. pet product searches starting on Amazon. For brands selling Dog food, Cat food, or Cat tree products, visibility on Amazon Ads is no longer optional—it’s mission-critical. However, competition from national brands and aggressive private labels makes scaling Amazon Ads for pet products increasingly complex.

This guide breaks down how pet brands can win visibility, control costs, and scale growth using competitor intelligence—while aligning tightly with advanced pet e-commerce advertising strategies.

Why Amazon Ads Matter in Pet E-commerce Advertising

Pet owners on Amazon are not browsing casually. They are typically searching with strong purchase intent, using phrases like “best grain-free dog food” or “durable cat tree for large cats.” These high-intent pet owner search terms make Amazon Ads one of the most powerful channels for pet product lead generation.

However, Amazon’s algorithm rewards:

- Conversion velocity

- Listing relevance

- Historical ad performance

Without strategic insights, brands often overspend on paid ads for pet products without seeing sustainable returns.

This is where competitive intelligence becomes essential.

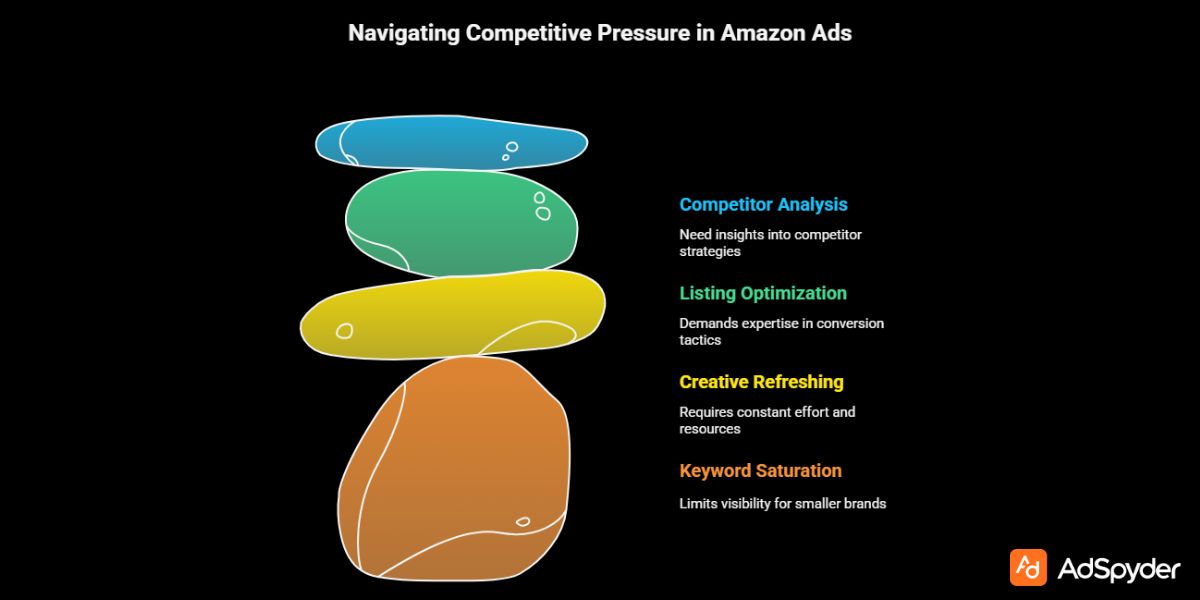

Understanding Competitive Pressure in Amazon Ads for Pet Products

Large pet brands dominate Amazon by:

- Saturating keywords

- Refreshing creatives frequently

- Optimizing listings for conversion

Smaller or niche brands selling Dog food, Cat food, or Cat tree products often struggle to rank—even with quality products.

To compete effectively, brands must first analyze:

- Which competitors dominate sponsored placements

- How they structure pricing and social proof

- What creative angles they use consistently

Platforms like AdSpyder enable this by tracking competitor Amazon ads for pet products and surfacing actionable insights that most sellers never see.

Winning Product Visibility with Smarter Keyword Strategy

Amazon keyword success isn’t about volume—it’s about intent.

Before launching campaigns, brands should understand:

- Which keywords drive conversions (not just clicks)

- How competitors group keywords by product variation

- Which long-tail phrases reduce CPC while maintaining volume

A refined keyword strategy complements broader pet supplies digital marketing efforts and supports sustainable growth.

Before diving into execution, it’s important to understand how keyword intelligence works in search-driven channels. Brands running both Amazon and Google campaigns can align learnings from Google Ads for pet supplies, ensuring cross-platform efficiency.

Optimizing Listings to Support Amazon Ads Performance

Amazon Ads cannot outperform weak product listings. Conversion rate is one of the strongest ranking signals.

High-performing pet listings typically include:

- Clear benefit-focused titles (nutrition, durability, size)

- Lifestyle imagery showing real pets

- Bullet points addressing pain points (allergies, anxiety, longevity)

Before scaling spend, brands should study how competitors structure their listings and funnels. This mirrors best practices found in pet e-commerce advertising strategies focused on full-funnel optimization, not just traffic acquisition.

Creative Strategies That Drive Clicks for Pet Products

Pet purchasing decisions are highly emotional. Successful Amazon creatives often focus on:

- Pet happiness and wellness

- Owner peace of mind

- Problem-solving (digestive health, destructive scratching)

For example:

- Dog food ads emphasizing clean ingredients and energy levels

- Cat food creatives highlighting picky eater approval

- Cat tree visuals showing sturdiness and multi-cat households

These creative principles align closely with social strategies of Facebook ads for pet products, where emotional resonance directly impacts performance.

Using competitor data allows brands to identify which visuals and messaging styles consistently outperform—then generate fresh, differentiated creatives inspired by proven winners.

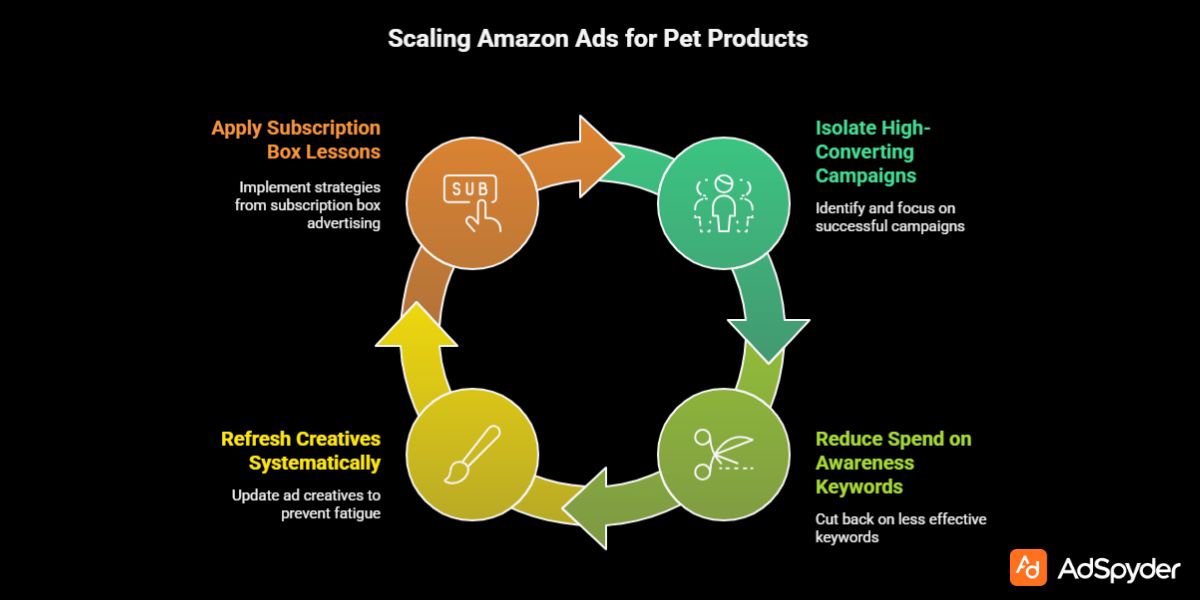

Scaling Amazon Ads for Pet Products Without Increasing CPA

One of the biggest challenges in paid ads for pet products is rising acquisition costs. According to industry benchmarks, Amazon CPCs in the pet category have increased by over 25% year-over-year.

To scale profitably:

- Isolate high-converting ASIN-level campaigns

- Reduce spend on awareness-only keywords

- Refresh creatives systematically to prevent fatigue

Subscription-focused brands can apply lessons from pet subscription box advertising campaigns where creative refresh cycles and funnel continuity play a critical role in maintaining low CPA and high lifetime value.

Leveraging Historical Competitor Data for Long-Term Growth

Pet purchasing patterns are seasonal. Demand spikes during:

- New pet adoption cycles

- Holiday gifting seasons

- Health-related periods (shedding, allergies)

Brands that analyze historical competitor ad data can:

- Anticipate seasonal budget shifts

- Prepare creatives ahead of demand surges

- Avoid reactive, expensive bidding wars

This long-term perspective supports scalable pet product lead generation and aligns with omnichannel growth strategies for local pet supplies advertising.

How AdSpyder Supports Amazon Ads Success for Pet Brands

AdSpyder for pet product brands brings clarity to Amazon advertising by enabling brands to:

- Track competitor Amazon Ads for pet products daily

- Analyze keyword positioning and creative trends

- Visualize landing page and funnel performance

- Generate AI-powered creatives inspired by top performers

All of this ties back into a unified pet e-commerce advertising hub that connects research, execution, and optimization into a single workflow.

FAQs: Amazon Ads for Pet Products

Are Amazon Ads effective for pet products?

Yes. Pet products have high repeat demand and strong purchase intent, making Amazon Ads highly effective when optimized correctly.

What pet products perform best on Amazon Ads?

Dog food, Cat food, Cat tree products, and Dog beds consistently rank among the highest-performing categories.

How can I reduce CPA for Amazon Ads pet products?

Focus on long-tail keywords, optimize listings for conversion, and refresh creatives based on competitor insights.

Do Amazon Ads work for niche pet brands?

Yes, especially when using precise targeting and differentiated messaging informed by competitor data.

How often should I refresh Amazon ad creatives?

Top brands refresh every 4–6 weeks to prevent creative fatigue.

Can Amazon Ads support pet subscription models?

Absolutely. Amazon Ads are effective for first-purchase acquisition, which can later convert into subscriptions.

How does competitor tracking improve Amazon Ads performance?

It reveals winning keywords, pricing strategies, and creative formats—reducing guesswork and wasted spend.

Conclusion

Winning on Amazon isn’t about spending more—it’s about spending smarter. When you combine listing optimization, intent-led targeting, and disciplined creative testing, Amazon Ads for pet products becomes a predictable growth engine for Dog food, Cat food, and Cat tree brands. The fastest path to scale is learning from what already works in your category—then launching differentiated campaigns with confidence.