Young entrepreneurs including social media insights are embracing dropshipping as a very popular business strategy since it provides a low-cost, low-risk way to generate income online. There are plenty of payment gateways and other technology available to aid you in this process, and it’s a fantastic way to start a dropshipping business. If you are building up a new online business and seeking the finest payment gateways for dropshipping, then here are the details that you need to know.

Ready to Elevate your Marketing Strategy?

What is a Payment Gateway for Dropshipping?

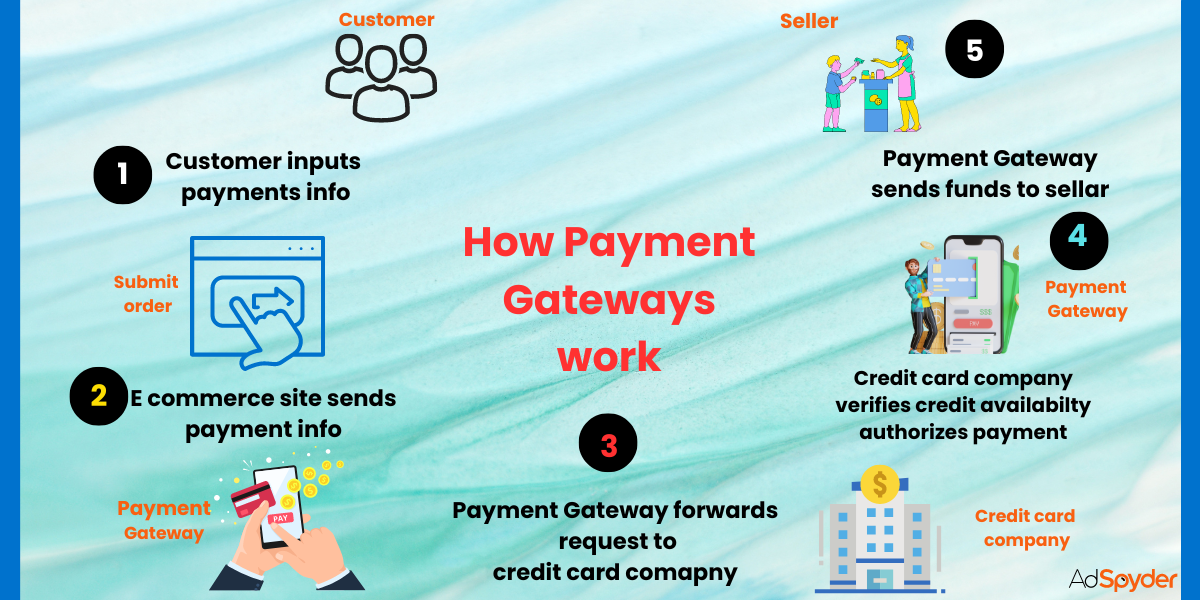

A payment gateway plays a vital role in dropshipping, enabling video marketing for social media by showcasing products effectively. Payment gateways manage all financial transactions for an online store. Payment gateways ensure that the payment data is handled safely and that the money is taken out of the buyer’s account. The funds are then deposited into the drop shipper’s account and made available for withdrawal from your bank account. The payment gateway keeps a tiny portion of the transaction amount as their service charge.

Selecting the Best Payment Gateway for Dropshipping India

Choosing the right payment gateway is crucial for running a successful dropshipping business. Here are the key factors to consider when selecting the best payment gateway for your store:

1. Consider Transaction Fees and Costs

Payment gateways charge different fees, which can affect your profit margins.

-

Transaction Fees: Most payment gateways charge a percentage of each transaction, plus a fixed fee. For example, PayPal charges around 2.9% + $0.30 per transaction in the U.S.

-

Monthly Fees: Some gateways charge a monthly subscription fee, while others are pay-per-use. For example, Authorize.net has a monthly fee but offers advanced features like fraud prevention.

-

Currency Conversion Fees: If you’re selling internationally, pay attention to any currency conversion fees that could add up when handling multiple currencies.

2. Global Reach and Multi-Currency Support

If your dropshipping store targets international markets, it’s essential to select a gateway that supports multiple currencies and countries.

-

Multi-Currency Support: Ensure the gateway accepts payments in the currencies of your target markets.

-

International Coverage: Choose a payment gateway that operates in the regions you plan to sell in. Gateways like Stripe and 2Checkout have extensive global coverage.

-

Localized Payment Options: Offering local payment methods (like iDEAL in the Netherlands or SEPA in Europe) can boost conversion rates by giving customers options they’re familiar with. It also allows you to provide convenient means for transactions, which can become your USP.

3. Payment Security and Fraud Prevention

Payment security is a major concern for both merchants and customers. In a world where fradulent transactions can negatively affect your brand, having a payment gateway with robust security features will help you to track competitor’s display ads effectively and avoid these scenarios.

-

PCI Compliance: Ensure the gateway complies with the Payment Card Industry Data Security Standard (PCI DSS), which sets guidelines for secure payment processing. Also keep a check on any integration compliances required from your end.

-

Fraud Detection: Look for gateways that offer built-in fraud detection tools, such as AVS (Address Verification System) and CVV checks. Also see whether the gateways are securely saving the card details for future transactions, which help in both security and convenience in transacting.

-

Data Encryption: Make sure the payment gateway uses advanced encryption methods like SSL to protect sensitive customer data. These encryptions make sure the transactions are handled without any possibility of transaction frauds.

4. Seamless Integration with E-Commerce Platforms

Your payment gateway must integrate smoothly with your dropshipping platform. These make sure your customers do not face any issues in making seamless transactions.

-

Platform Compatibility: Check if the gateway integrates with popular e-commerce platforms like Shopify, WooCommerce, BigCommerce, or Magento. Shopify, for example, offers Shopify Payments for seamless integration. These integrations greatly reduces failure rates and if there are any issues, it can be easily resolved with the help of their customer services.

-

Ease of Integration: Some payment gateways offer easy plug-and-play integrations, while others might require more advanced technical setup. Look for gateways with a simple setup process if you’re not tech-savvy.

-

API Availability: For custom dropshipping stores, having a payment gateway with a robust API allows for better customization and control over the checkout experience. It also helps you automate reports for easy tracking of sales and transactions.

5. Customer Experience

A smooth checkout process is critical for enhancing brand loyalty with video marketing, allowing you to connect better with your audience and boosting conversions.

-

Fast and Simple Checkout: Look for gateways that allow for a quick, user-friendly checkout experience. A one-click checkout option can significantly improve conversion rates.

-

Mobile Payment Options: With a growing number of consumers shopping via mobile, make sure the payment gateway supports mobile-friendly payments like Apple Pay, Google Pay, or other digital wallets. These options help customers quickly pay for your services without having to read from a card or remember any passwords.

-

Guest Checkout: Ensure the gateway offers a guest checkout option, so customers don’t need to create an account to complete a purchase. Having a compolsory sign-up can sometimes make customers shy away from going through the transaction.

6. Payment Methods Supported

Different customers prefer different payment methods. Some prefer payment through their cards, while some others prefer mobile payments. Some may also go for pay-later schemes, which help them transact easily in the platform. Offering a variety of options can increase your sales.

-

Credit and Debit Cards: All payment gateways should accept major credit and debit cards like Visa, MasterCard, and American Express.

-

Digital Wallets: Consider gateways that support popular digital wallets such as PayPal, Apple Pay, Google Pay, and Amazon Pay. These offer customers with flexible payments. This in turn leads to positive experience while shopping on your website or app.

-

Alternative Payments: Support for methods like Buy Now, Pay Later (BNPL) through services like Klarna or Afterpay can attract more customers.

7. Payout Time and Cash Flow

Best dropshipping payment gateway businesses need a healthy cash flow to sustain operations. It is one of the most important rules to follow strictly.

-

Payout Schedule: Different gateways have varying payout schedules. For instance, Stripe typically pays out in 2-7 days, while PayPal can take up to a week for certain transactions. Check for these payout options. For starting stages, you may need a quicker payout schemes.

-

Instant Access: Some gateways, like PayPal, allow instant access to funds, but they might charge extra fees for this service. Sometimes, waiting for a few days before accessing your funds can help you save money on these platform specific charges.

8. Customer Support and Reliability

Reliable customer support is vital in case of payment issues or technical problems.

-

24/7 Support: Opt for payment gateways that offer 24/7 customer support, ideally through multiple channels like live chat, phone, and email.

-

Service Uptime: Ensure the gateway is known for its reliability and minimal downtime to avoid losing sales during high-traffic periods.

-

Dispute Resolution: Look for gateways that offer support in case of disputes or chargebacks. Gateways like PayPal and Stripe provide robust dispute management tools.

9. Scalability

As your dropshipping business grows, your payment needs will evolve.

-

Growth Flexibility: Select a gateway that can grow with your business, handling increased transaction volumes without major fee increases.

-

Advanced Features: As your store scales, features like recurring billing, subscription payments, and advanced reporting might become more important. Ensure your gateway supports these.

10. Reputation and User Reviews

Finally, check the reputation and reviews of payment gateways before making a final decision.

-

Merchant Reviews: Read reviews from other dropshipping business owners to learn about their experiences with different gateways.

-

Reputation for Disputes: Some gateways are known for freezing accounts or being difficult during disputes. Ensure the gateway you select has a good reputation for handling such situations fairly.

Available Payment Solution For Dropshipping

There are various payment gateways one could use for making their dropshipping business. Let us look at some of the most popular and reliable ones.

| Payment Gateway | Key features | Fees | Supported Currencies | Supported Countries |

|---|---|---|---|---|

| PayPal | Well-known, easy to use, high security, multi-currency support, easy integration with e-commerce platforms | 2.9% + $0.30 per transaction for local payments, 4.9% for international payments | Over 20 currencies including USD, GBP, AUD, CAD | Operates in over 200 countries |

| 2Checkout | Supports multiple languages, PCI compliance, multi-currency payouts, strong fraud protection | 3.5% + $0.35 per successful sale | Over 100 currencies | Available in over 200 countries |

| Authorize.net | Advanced fraud protection, easy checkouts, digital invoicing | $79 for one site with one year of support and updates | Supports all popular credit cards | USA, UK, EU, Australia, Canada |

1. Paypal

A significant company that is popular with both drop shippers and the general public is PayPal. Who doesn’t know it? Many customers are well acquainted with and comfortable using this payment provider, which will be a great addition to your dropshipping business!

Another benefit of PayPal is that it has become globally accepted and has earned people’s confidence. Some of the customers already use PayPal and it is quite advantageous because the services are already paid for and secured. Adding PayPal as an option to your dropshipping business can be extremely beneficial to your customers and may raise the level of trust and, therefore, conversions.

In addition, PayPal can be easily integrated into several e-commerce platforms to operate smoothly for both merchants and customers. Indeed, their strong buyer protection policies also contribute to enhancing security for customers so that their purchases are safeguarded.

Further, PayPal allows customers to pay and transact in multiple currencies; a feature that is very useful for dropshipping stores targeting various markets around the globe. This freedom ensures that you can expand your client base significantly without worrying about currency fluctuations or the problems involved in conducting international transactions.

Pros:

- Well-known among people worldwide

- Easy to use

- High security measures, and buyer protection measures

- Currencies: There is like provision for multiple currencies so that businesses that involve international transactions can embrace the use of this software.

- Another feature that has been incorporated is to ensure that the application works in harmony with e-commerce platforms.

2. 2Checkout

2Checkout is also among the most secure payment processing platforms for any kind of dropshipping business, which makes it a perfect fit for merchants. Being available in over 87 countries globally, it provides a wide coverage that is appropriate for international operations. Thus, the platform supports all international credit cards such as Visa, MasterCard, Diners Club, American Express, and others, which will create a comfortable and non-restricted payment environment for customers.

Pros:

- Supports multiple languages: This feature proves that 2Checkout is convenient and available for all types of customers since it translates the interface into different languages for customers’ comfort.

- PCI compliance: This provides the necessary security for payment processing, thus safeguarding any card data and limiting the chances of fraud.

- Multi-currency payouts: Allowing businesses to accept payments in different currencies makes it easier for them to conduct business across international borders as well as helping individual merchants who may be receiving payments in different currencies for their business transactions across the world.

3. Authorize.net

Next on our list of payment gateways for dropshipping is authorize.net. It is located in more than 33 countries, which makes it a very flexible payment gateway for businesses from all over the world. It has been established as one of the most consistent and oldest payment gateways online and has stood the test of time to be trusted and reliable in the payment gateway industry.

In addition to the payment processing services, Authorize provides other services that are considered complementary to the main service. net has several add-ons and features that allow to integrate into WooCommerce-stores with ease. This flexibility helps in that online merchants can easily establish their payment system with little difficulties that would hamper efficiency in the transaction process.

A key advantage of using Authorize.net is its low transaction fees which are relatively lower than most of the other payment platforms, especially for dropshippers and e-commerce businesses. It also means businesses can increase their revenue and the value of their services and products, as well as offer their clients a secure payment solution.

Pros:

- Advanced fraud protection: Authorize. net also comes with enhanced security that is useful in combating all the fraudulent cases that are present between businesses and their customers, thus providing much-needed security and trust.

- Easy checkouts: One of the benefits of using the given platform is that it provides a convenient and seamless experience for the buyers throughout the checkout process, which ultimately helps increase conversion rates and customer satisfaction.

- Digital invoicing: Authorize. net is another means through which companies can be afforded easy ways of issuing bills online hence enhancing their cash flow.

Best Payment Gateways For Dropshippers In India Including UPI

Let us look at some of the best-suited payment gateways for Indian drop shippers.

| Payment Gateway | Key features | Fees | Supported Currencies | Supported Countries |

|---|---|---|---|---|

| Razorpay | Supports UPI, wallets, debit/credit cards, online banking, trusted by major companies in India | 2% per transaction | INR, USD, and more | India |

| Instamojo | Secure payment gateway, integrated marketing tools, CRM, analytics, shipping | 2% + ₹3 per transaction | INR | India |

| Google Pay | Quick, simple, practical, stores credit card info for faster payments | None for customers | Supports major credit and debit cards | Available in multiple countries including USA, UK, India |

RazorPay

RazorPay enables dropshippers to access wallets like JioMoney and MobiKwik as well as debit and credit cards, online banking, UPI, and wallets. Unacademy, UrbanClap, Zoomcar, Groofers, and BookMyShow are well-known companies using the Razorpay payment platform. RazorPay is one of the most well-known payment gateways in India.

Instamojo

Instamojo is a very trusted full-stack SME platform. It is super easy to start an online business with Instamojo because it offers secure payment gateways, integrated marketing tools, and more. Instamojo helps more than 15 lakh independent enterprises in India with its reliable payment gateway. With the help of Instamojo’s Web platform, dropshippers can create their store and link a simple payment gateway to it. Instamojo also handles CRM, analytics, and shipping.

Google Pay

Another reputable and well-known payment option that would be ideal for your dropshipping company is Google Pay. If you have ever used Google Pay for yourself, you are aware of how quick, simple, and practical it is to make a payment. Additionally, it enables you to keep and store your credit card information on your Google Account, which speeds up online payments for goods, apps, and services.

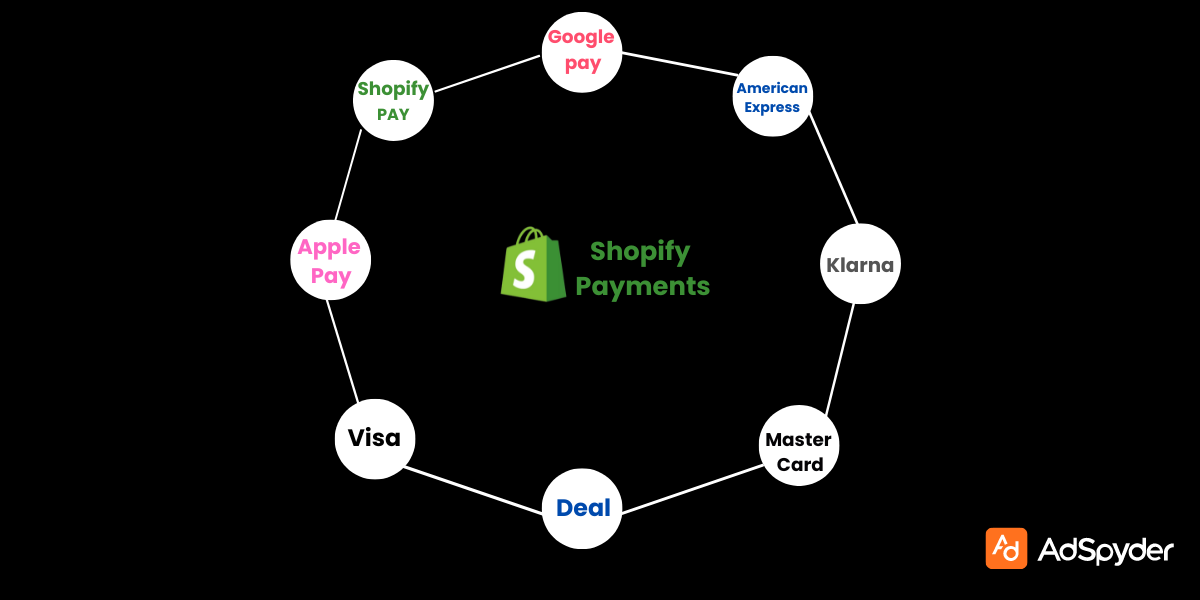

Shopify Payments For Dropshipping

The Shopify platform and Shopify Payments are connected. It’s easy to set up dropshipping on Shopify. It just requires a few clicks. You can kick off your dropshipping business journey with it. Shopify offers a variety of benefits, such as.

- Being incredibly easy to set up

- accepts most major credit cards

- Payouts are done every 3 business days.

Payment Gateway Options For Woocommerce

WooCommerce has a “WooCommerce Payments” gateway that enables you to make your payments on the website successfully. WooCommerce payments are fully integrated into Woo. It accepts all the major credit and debit cards and other local payment options with no extra charges. This platform offers other popular payment gateways like Amazon Pay, Stripe, and AfterPay.

Best WooCommerce Payment Methods

Typically, the available payment options in WooCommerce stores are similar. But you need to take some measures to distinguish yourself from the competitors and provide your customers with other means of payment. Here are the most effective WooCommerce payment gateways for dropshipping:

| Payment Gateway | Key features | Fees | Supported Currencies | Supported Countries |

|---|---|---|---|---|

| AliPay | Privacy, real-time monitoring, high-level security, chargeback protection | 1% on credit card payments over $294 | AUD, CAD, EUR, HKD, GBP, SGD, USD | India, South Asia, and more |

| Amazon Pay | PSD2 compliance, multi-currency support, recurring payments, payment protection | 2.9% + $0.30 per transaction | AUD, GBP, EUR, USD, and more | USA, UK, Germany, France, and more |

| Apple Pay | Supports purchases in online and brick-and-mortar stores, real-time monitoring | 0.15% per transaction in the US | Supports major credit/debit cards | Over 30 countries |

| Authorize.net | Advanced fraud protection, easy checkouts, digital invoicing | $79 for one site with one year of support and updates | Supports all popular credit cards | USA, UK, EU, Australia, Canada |

| Braintree | innovative payments technology, scalable solutions, and white-glove support | 2.59% + $.49 per transaction | AUD, CAD, HKD, SGD, USD, EUR, GBP, CHF, CNY, JPY, KRW, ZAR | over 45 countries |

| PayPal | Well-known, easy to use, high security, multi-currency support, easy integration with e-commerce platforms | 2.9% + $0.30 per transaction for local payments, 4.9% for international payments | Over 20 currencies including USD, GBP, AUD, CAD | Operates in over 200 countries |

| Skrill | Prepaid card system, real-time monitoring, prevents exceeding limits | 1.3% transfer fee, 0.99% mark-up on exchange rates | EUR, GBP, USD, and more | Over 200 countries |

| Stripe | SSL encryption, white-label approach, cost-effective, fraud management | 2.9% + $0.30 per transaction, discounts based on volume | Over 135 currencies | Available in 26 countries |

| Verifone (2Checkout) | Supports online and mobile payments, effective API, global coverage | 3.5% + $0.35 per successful sale | Over 100 currencies | Over 200 countries |

1. AliPay

Many people are familiar with AliPay if they have ever done business with any Chinese company. It is widely used in the Chinese market and is also gaining popularity in other countries. AliPay has over 550 million active users globally and has been averaging 8. 5 million transactions daily.

AliPay is a payment processing tool that promotes privacy, real-time monitoring, and high-level security of payments. In terms of stability, the platform can comfortably handle the large number of simultaneous transactions that your online store may be experiencing. It is also supported on different browsers, including those available on mobile phones.

The payment gateway protects its users with the guarantee of chargeback – a complete refund for unauthorized transaction and 90 days of payment protection. Partner merchants have their international bank accounts in any of the twelve supported currencies and international settlements are transferred directly to the merchant’s bank account.

Fees

- 0. Some credit card charges a transaction fee of 1% on credit card payments of more than $294.

Supported Currencies

- AUD; CAD; EUR; HKD; GBP; SGD; USD.

Supported Countries

- India and the rest of South Asia including Thailand, Philippines, Indonesia, Pakistan, Bangladesh, Korea, Hong Kong, Malaysia.

2. Amazon Pay

Amazon Pay is a payment system operated by Amazon. They enable customers to make payments with their Amazon account details which often involve an email address and password for authentication. There are no other requirements apart from having an active Amazon account.

One more benefit is that consumers do not have to provide their payment details on a third-party platform. Amazon is a facilitator that works between the customer and the online store. For consumers, there are no charges for either setting up or using an Amazon Pay account.

Options include credit card or direct debit depending on the setting in the Amazon account. Commission which is approximately 1 is charged on sellers. 9% and $0. 35 per transaction as PayPal does.

Key Features

- PSD2 compliance

- Multi-currency support

- Recurring payment capability

- Automatic decline handling

- Payment protection policy

- Amazon Pay A-to-z Guarantee

- Delivery notifications

Fees

- Domestic processing fee: 2.9% + $0.30 per transaction, plus applicable taxes

Supported Currencies

- AUD, GBP, DKK, EUR, HKD, JPY, NZD, NOK, ZAR, SEK, CHF, USD

Supported Countries

- USA, UK, Germany, France, Italy, Ireland, Spain, Luxembourg, Austria, Belgium, Cyprus, Netherlands, Sweden, Switzerland, Portugal, Hungary, Denmark, Japan

3. Apple Pay

Apple Pay started as a mobile application for making payments that was available only to owners of certain new Apple gadgets. First developed using the iPhone’s NFC (near-field communication) platform, it now works for purchases in online stores, brick-and-mortar stores, and selected applications, such as Airbnb, Starbucks, and Kickstarter.

Though it initially launched in the United States, Apple Pay has since spread to other countries such as France, the United Kingdom, and Switzerland, among others, with the plan of expanding to other countries in Europe.

Fees

- 0. 15% on each transaction in purchases made in the US.

Supported Currencies

- American Express, Visa, Mastercard, and other credit and debit cards are accepted.

Supported Countries

- More than 30 countries and regions.

4. Authorize. net

It is another popular WooCommerce payment gateway that is well known for its easy installation and handling of payments. It enables businesses to process credit cards and e-checks right on the business page without having to forward the customers to another page for the transaction to be processed; it also strengthens security.

It supports all the popular credit cards from Mastercard, Visa, American Express, Discover, JCB, and Diners Club by showing their logos on the checkout page. The plugin also makes it possible for customers to pay using a checking, business checking, or savings account through e-checks.

Authorize. net has a user-friendly control panel that allows for effective payments administration, transaction recording, and refunding. It also has partial refund support and provides simple configuration for the payment page.

Fees

- $79 for one site with one year of support and updates.

Supported Countries

- USA, UK, EU, Oz, Canada.

5. Braintree

Braintree was founded in 2007 and offers an easy method to offer online payment options; it also offers the ability to accept split payments from several sellers. Braintree is fully PCI-DSS compliant and has a robust fraud management solution.

Braintree is a payment gateway that supports 135 plus currencies and has features such as regular payment options, comprehensive reporting, and split payments. But it does not support escrow funds in a marketplace.

Fees

- 2. 0. 09 + 0. 30 per transaction.

Supported Currencies

- Braintree currently supports 135+ currencies. and available in over 45 countries

6. Paypal

PayPal is one of the first and the most popular electronic payment systems. It enables users to see credit cards, bank accounts, and addresses to purchase easily at your store. It is quite common that PayPal is the primary payment option for most e-commerce platforms.

PayPal has high security options for both the buyer and seller with a well-defined resolution of disputes. It also has an intuitive interface for transaction processing and reporting tools that support exporting data in different formats.

Fees

- 2. 9% USD + $0. 30 per transaction for local payments.

- 4. 9% to the transaction amount for international payments.

Supported Currencies

- More than 20 currencies supported including USD GBP AUD CAD.

Supported Countries

- operates in over two hundred countries across the world.

7. Skrill

Moneybookers is one of the prepaid card payment systems from England and is also known as Skrill. They are pre-paid with a customer account that enables you to monitor spending and prevent exceeding certain limits via your credit card or bank account.

Fees

- 1. 3. Transfer fee 9% and . A 99% mark-up on its exchange rates.

Supported Currencies

- EUR, GBP, USD, DKK, RON, CZK, HUF, PLN, SEK, CAD, SGD, CHF, NZD, BGN, AUD, NOK.

Supported Countries

Currently operating in more than 200 countries.

8. Stripe

Stripe is a web application that makes it possible for your clients to pay for your goods through credit cards in your WooCommerce website. It includes SSL certificate for data encryption. Stripe’s white-label approach allows customers to remain on your site when processing transactions for a more seamless buying experience.

Stripe is also cost-effective as it offers discounts based on the transaction volume and an opportunity to get better terms from the bank.

Fees

- 1. 0. 04 + 0. 25 for European cards.

- 2. 9% + $0. 25 for a non-European card.

Supported Currencies

- Supports over 135 currencies

Supported Countries

- Available in 26 countries

9. Verifone

2Checkout (recently rebranded as Verifone) is a global payments processor offering services for e-businesses that need to accept online and mobile payments. It serves over 200 countries and accepts the usual credit cards and PayPal. Verifone’s API is quite effective and can be used with platforms such as Shopify, Wix, Ecwid, and WooCommerce.

Fees

- 3.5% + $0.35 per successful sale, with access to recurring billing

Supported Currencies

- Accepts payments in over 100 currencies

Supported Countries

- Available in over 200 countries

Real-Life Examples of Successful Dropshipping Businesses Utilizing Payment Gateways

The selection of an appropriate gateway for payment in the world of dropshipping can be a pivotal factor in your business’s success. To get first-hand experience as to how entrepreneurs leverage different payment gateways in their dropshipping ventures, we give you real-life case studies and success stories. Let’s dive into these inspiring examples: Let’s dive into these inspiring examples:

1. Bella’s Boutique: Using PayPal to Grow a Business

Bella, the founder of Bella’s Boutique, set out on her entrepreneurial journey to start an online boutique dealing in handmade jewelry. At the beginning, it was not easy for Bella to handle inventory and orders. PayPal, which is her preferred payment gateway, has helped a lot.

Insights: Bella discovered that PayPal was an accepted payment method, which raised customer confidence and ultimately increased the number of conversions.

Challenges Faced: The very beginning was the hardest part for Bella, as she struggled with managing the inventory properly. However, Bella soon streamlined her operations by integrating PayPal which gave her more time to market her products and to better serve her customers.

Strategies Employed: Through PayPal’s invoicing function, Bella tracked payments and provided a discount for customers who used PayPal, which consequently led to higher sales.

2. TechTrends: Global Expansion via 2Checkout

TechTrends, a global electronics dropshipping store that is targeting customers, was facing the problem of fraud and chargebacks in high-risk countries. While they failed at it, they managed to make it by using 2Checkout and payment gateway.

Insights: To TechTrends, 2Checkout has been the ideal option, thanks to its global coverage and support for different currencies, which significantly simplify all the transactions in the world.

Challenges Faced: Combatting fraud and chargebacks were the primary obstacles, specifically in high-risk markets. However, the fraud protection features of 2Checkout helped to soften the risks involved.

Strategies Employed: TechTrends benefitted greatly from 2Checkout’s analytics as it could detect fraudulent transactions early on and thus developed more stringent verification measures. The other services they offer include safe payment options like 3D Secure, which help build customer trust.

3. Indian Apparel Co.: Indian Market’s Twin with Razorpay

Indian Apparel Company, a company that offers ethnic dresses for women in India, can credit RazorPay as their payment gateway for their success.

Challenges Faced: While the Indian market is very dynamic and cash management is critical, we have been successful in dealing with these challenges. Despite that, RazorPay’s simplified interface and fast settlements contributed in a way that made the processes easier.

Strategies Employed: Indian Apparel Co. aimed to encourage the use of UPI by granting exclusive discounts to customers using this mode of payment and presented RazorPay’s secure payment features to build the confidence of customers who were skeptical about online transactions.

FAQs

1. What is dropshipping, and how does it work?

2. Why is selecting the right payment gateway important for dropshipping businesses?

3. What factors should I consider when choosing a payment gateway for my dropshipping business?

transaction fees, supported payment methods, security features, integration with e-commerce platforms, geographic coverage, customer support, and ease of use.

4. What are some popular payment gateways used by dropshipping businesses?

5. How do payment gateways handle chargebacks in dropshipping transactions?

6. Are there any additional fees associated with using payment gateways for dropshipping?

7. Can I use multiple payment gateways for my dropshipping business?

8. How can I ensure the security of payment transactions in my dropshipping store?

9. Do I need a merchant account to use a payment gateway for dropshipping?

10. What support options are available if I encounter issues with my chosen payment gateway?

11. Does Stripe allow dropshipping?

12. How to set up Shopify Payments for dropshipping?

Ensure Eligibility: Make sure that Shopify Payments is available in your country and that your products comply with Shopify’s Acceptable Use Policy.

Configure Shopify Payments: Go to your Shopify admin panel.

Click on ‘Settings’ and then ‘Payments’.

If you have another credit card payment provider enabled, deactivate it to see the option to activate Shopify Payments.

Complete the account setup by entering your business details and banking information.

Adjust Settings for Dropshipping: Specify your expected shipping times and clear refund policies in your store’s settings to manage customer expectations effectively.

Test Your Setup: Place a few test orders to ensure everything works as expected and that the payment gateway properly handles transactions.